By SJS Founder & CEO Scott Savage.

Irrespective of your opinion about wearing a mask, all of us can now better relate with what Batman (aka Bruce Wayne) had to deal with while fighting crime in Gotham City. As we begin the last quarter of a surreal 2020, SJS feels compelled to “unmask” the U.S. stock market’s performance year-to-date, shining a light on how the returns of just five stocks are obscuring how, in our opinion, the average U.S. publicly traded company is doing.

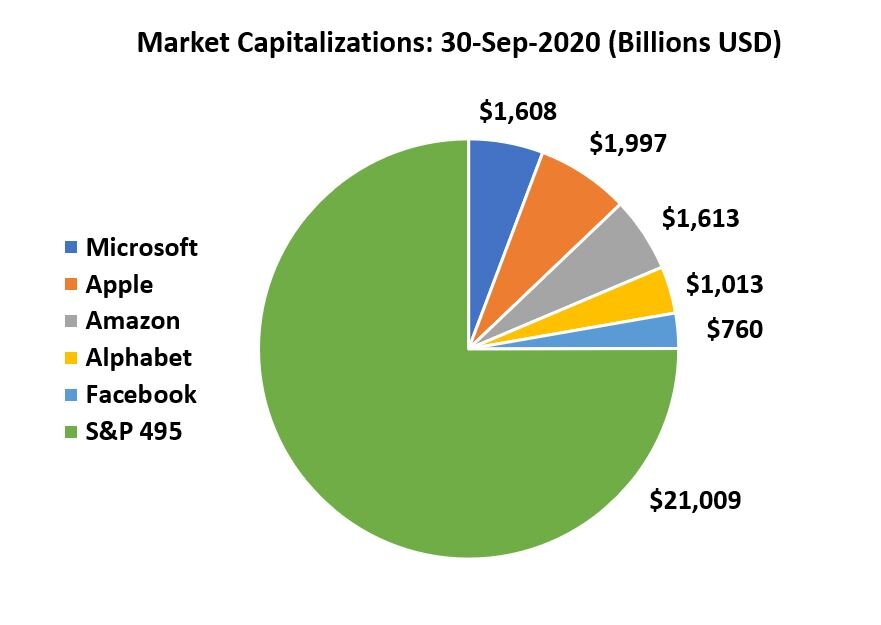

Despite unprecedented market volatility and the resulting decline fueled by panic selling in February and March, the S&P 500 Index has seemingly fully recovered. As of September 30th, the S&P 500 enjoyed a positive return of 5.6% year-to-date. During the same time, the “S&P 495”, that is, the same index with the five largest companies removed had a negative return, -7.7%! These five companies are Apple, Amazon, Microsoft, Facebook, and Alphabet (Google’s parent).

Sources: Yardeni Research and Yahoo Finance, as of 30-Sep-2020.

How did this happen? Well, the S&P 500 and many market indices are “cap-weighted” meaning, the larger the company, the more “weight” it carries in the index. In fact, these five companies made up 25% of the S&P 500 as of September 30th. And these five stocks have gained 47.5% year-to-date through the end of September. That’s right, 47.5%! This remarkable performance so far in 2020 has masked the fact that the average stock is down this year!

Sources: Yahoo Finance, as of 30-Sep-2020.

A similar phenomenon happened in the technology sector during the dot-com era of the late 1990’s. The dot-com bubble burst, and the average investor in an S&P 500 index fund earned no return during the subsequent ten-year period. Some have called this “the lost decade.” And with these five companies trading at a price earnings multiple of 35, we are happy to be more diversified in our investment strategies than these cap-weighted indices.

While we are not predicting a crash in the five companies that have led the U.S. market’s advance so far this year, diversification remains a foundational principle of MarketPlus Investing® and is instrumental in managing future risks and reaping future expected returns. Risks include those we perceive as well as those we cannot yet anticipate. Expected returns will vary across market environments, and the SJS Investment Committee reviews future capital market return expectations in decisions about investment design and asset allocation. Just another way that we work on your behalf to help you unmask the noise of the markets, and to focus on the time-tested strategies that can help you achieve your goals.

Important Disclosure Information and Sources

Past performance does not guarantee future results. Diversification does not eliminate the risk of market loss.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

SJS Investment Services has been recognized in the Forbes / SHOOK 2023 list of America’s Top RIA (Registered Investor Advisor) Firms.

In addition to family gifting, many individuals support giving to organizations that aim to help their communities. We highlight some strategies to make the most of your giving dollars.

You can consider putting excess cash into a money market fund, short-term U.S. Treasury bonds, or a short-term bond mutual fund / ETF.